Changing landscape of Pricing Model

AI Just Changed SaaS Pricing: Why Founders Should Think Outcomes, Not Seats

Pricing SaaS used to be simple, count users, set a fee, and you're good to go. AWS shook things up by charging based on usage, letting customers pay for exactly what they consumed, just like electricity bills. But now, AI is flipping the whole script again.

In fact, AI hasn't just changed pricing models but it’s rewritten the entire concept of value. If you're an AI startup founder, traditional SaaS pricing models probably feel outdated already.

Here’s why it's time to think differently, and why outcome-based pricing might just work for you.

The Old Way: Seats and Usage

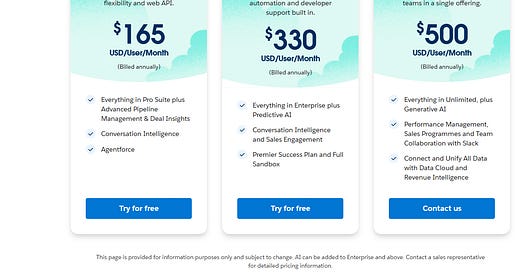

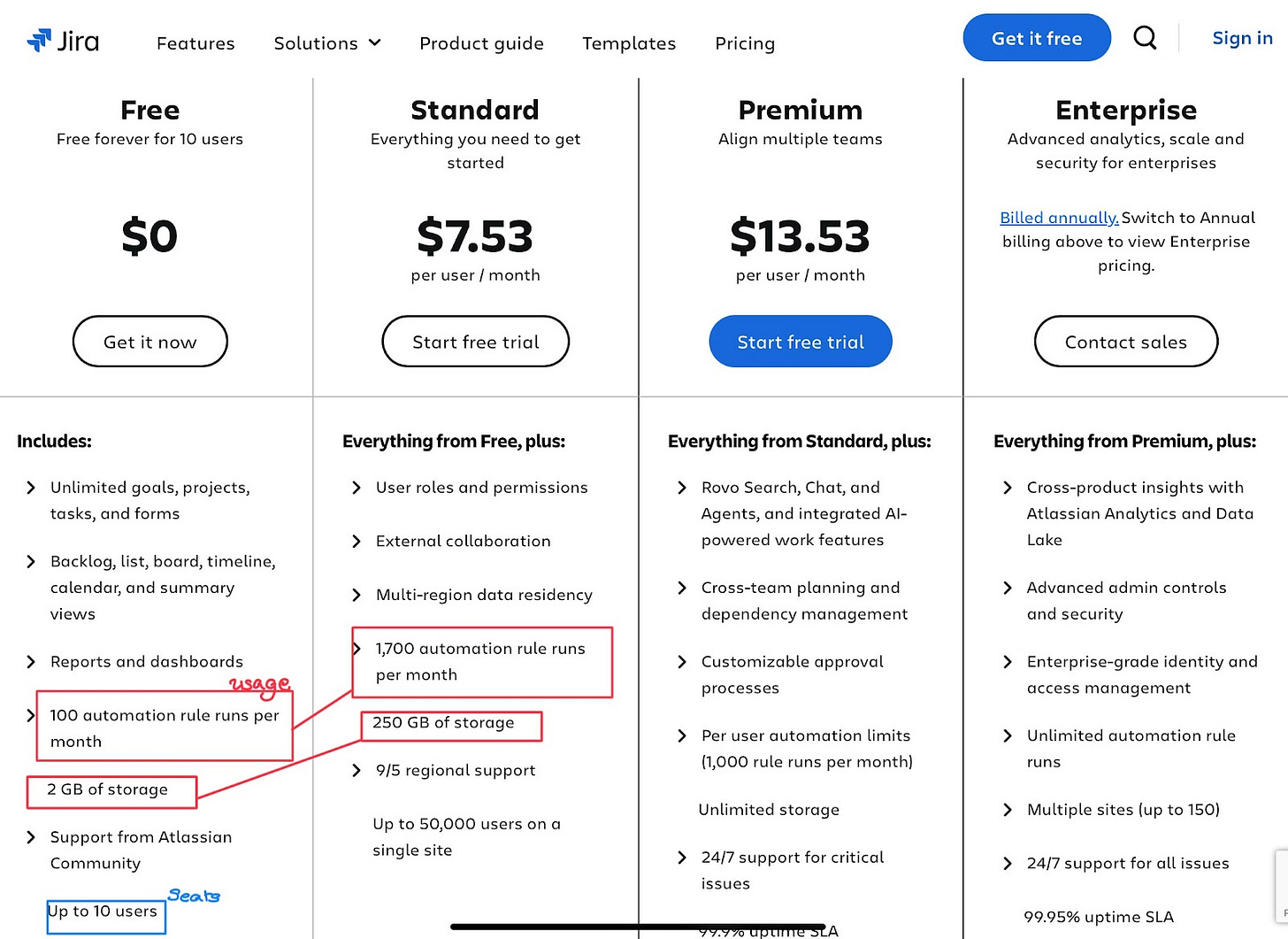

Seat-based pricing has long been the default model. Investors love it for its predictability, and it’s simple for customers—one seat, one price. While tiered plans added some flexibility by unlocking more features at higher levels, they were still detached from actual usage. The downside? If you buy ten licenses but only three people actively use them, it’s like paying rent for empty office space—inefficient and wasteful.

Usage-Based Pricing came along to fix that. Pay only for what you use—no waste. It worked wonders for APIs, cloud infrastructure, and developer tools. But it also introduced uncertainty. Bills fluctuated wildly, scaring budget-conscious enterprises. Plus, usage-based billing systems could become an operational nightmare for young startups.

There are two common types of usage-based pricing: a) pay-as-you-go and b) credit-based. Both models are based on actual consumption, but they differ in how billing is handled.

In a pay-as-you-go model, usage is tracked throughout a billing cycle—typically monthly—and users are charged based on what they consume during that period. This approach is popular among infrastructure providers like AWS.

In contrast, credit-based pricing involves purchasing a set amount of usage credits upfront, which can be drawn down over time. This model is more common in data and workflow-focused tools such as Mailchimp, Apollo, and others.

Faced with the limits of pure seat-based or usage-based pricing, SaaS companies started doing something smarter. They mixed both models—Hybrid pricing.

Hybrid Pricing had a simple idea behind it: offer a predictable starting point and then let customers pay more only as they extracted more value with increased usage. Hybrid pricing wasn’t just about protecting revenue. It became a "land and expand" motion in disguise. Customers could start small, see value quickly, and then grow their spending naturally as their needs deepened.

AI Changed Everything (Again)

AI tools supercharge productivity. Suddenly, fewer users can achieve more output. Imagine one marketing analyst completing the work of an entire team, thanks to AI-driven insights. That scenario isn't hypothetical—it’s happening today.

This poses a big question: if fewer people generate the same (or more) value, why keep pricing by seats or usage? AI shifts the focus from "how many" or "how often," to something far more related to value: outcomes.

Outcome-Based Pricing: The New Normal for AI Startups?

Instead of counting heads or API calls, outcome-based pricing asks one simple question: "What measurable result did your customer achieve?"

Here’s how it could look in practice:

An AI platform might charge based on how much time it saves customers per month.

A predictive analytics startup could price based on increased customer revenue driven by their insights.

AI-driven automation tools might set pricing around reduced operational costs or faster task completion.

In each case, the customer pays only when they see tangible results. No waste, no guesswork.

Why Outcomes Work

Pricing based on outcomes naturally aligns incentives. Customers feel safer—no results, no bill shock. For startups, successful customers grow naturally, becoming loyal, long-term partners without aggressive upsells.

It’s like being paid based on the harvest you deliver, rather than charging upfront for seeds. You thrive when customers do.

But Is It All Sunshine and Roses?

Outcome-based pricing isn't without challenges. You need robust ways to measure results, clearly and transparently. You’ll need to invest in analytics, tracking systems, and billing infrastructure. And yes, revenue predictability might feel shaky at first.

But these are solvable problems and founders who tackle them early could unlock significant growth.

So, What Should AI Founders Do Now?

Think about the real-world outcomes your product delivers. Define measurable metrics that your customers genuinely care about. And experiment with this model early, refining as you learn.

Investors pay attention here too. Outcome-based pricing signals startups that understand their customers deeply and align their success with tangible results. That’s the hallmark of truly innovative companies.

The Bottom Line for AI Founders

AI has changed the rules. Pricing on outcomes isn’t just the next step, it’s an entirely new game. It’s challenging but filled with potential.

After all, would you rather pay for seats or success?